Table of Content

Some lenders may look closely at your spending habits to see whether you can afford to meet loan repayments. The more careful you are with how and what you spend your money on, the greater your borrowing power may be. This calculator provides an estimated amount for illustrative purposes only. It is based on the accuracy of the limited financial information provided by you.

For example, your expenses, credit history, any debt you have and your deposit. Each of these things presents us with information that helps us understand whether you could afford your repayments. Your debts and what you spend each month are as crucial as your deposit, income and savings. Therefore, you need to consider any financial commitments and obligations you regularly pay to determine if your income is sufficient to make your repayments. One of the first factors a potential lender looks at when evaluating how much you can borrow, in addition to your deposit, is your income. Your income dictates how much you can repay from your loan each month, so lenders want to know if your income can meet the repayments for the size of the loan you want.

All calculators

If your credit report shows late payments, defaults and other harmful listings, you may find it challenging to obtain a loan. Therefore, always get a copy of your credit report before applying to a lender. LMI can cost you thousands of dollars, so if you want to avoid paying it, the best way is to save at least a 20% deposit before applying for a loan. Lenders' Mortgage Insurance is insurance you’ll need to pay if you borrow more than 80% of a property’s value (i.e. if you have less than a 20% deposit).

If you can show a history of genuine savings over time, this can help you demonstrate that you can make future home loan repayments. There are a range of factors that can affect your borrowing power, including your income, your expenses, your existing debts, your deposit and your credit score. You can use Canstar’s Home Loan Borrowing Power Calculator to estimate your borrowing power. This is based on your income and expenses as well as the home loan interest rate and loan term you select. Deposits are important lenders because they provide a buffer against potential losses should the borrower default on the loan. Lenders can also look at the size of the deposit to assess your reliability as a borrower.

Our home loans

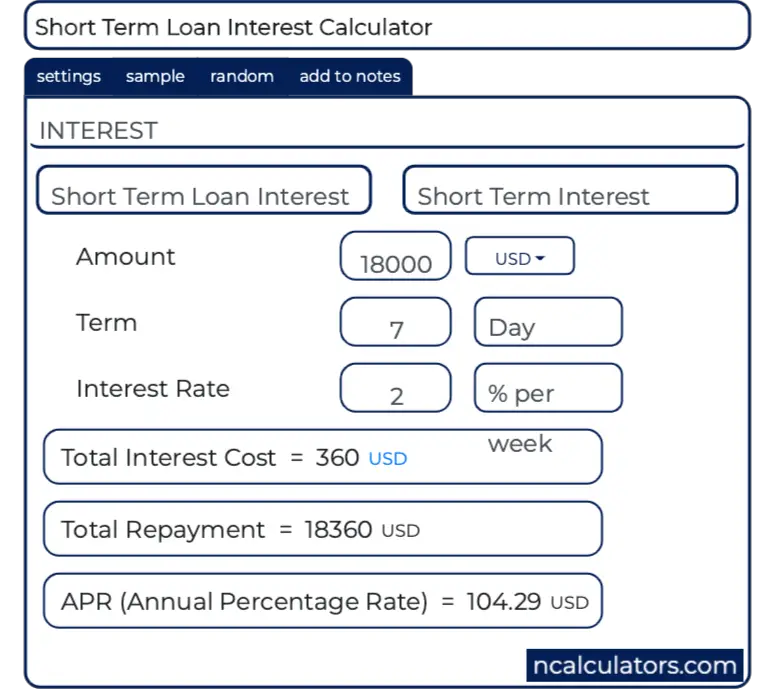

You also need to look at what features it offers you and if you could still comfortably afford the repayments if interest rates increased. Using things like borrowing calculators is an easy way to get an idea of how much you can borrow. Private Mortgage Insurance is calculated based on your credit score and amount of down payment. If your loan amount is greater than 80% of the home purchase price, lenders require insurance on their investment. This is a monthly cost that increases your mortgage payment. Most home loans can fund up to 85-95% of the value of your property, which means you’ll need a minimum of up to 5-15% as a home deposit.

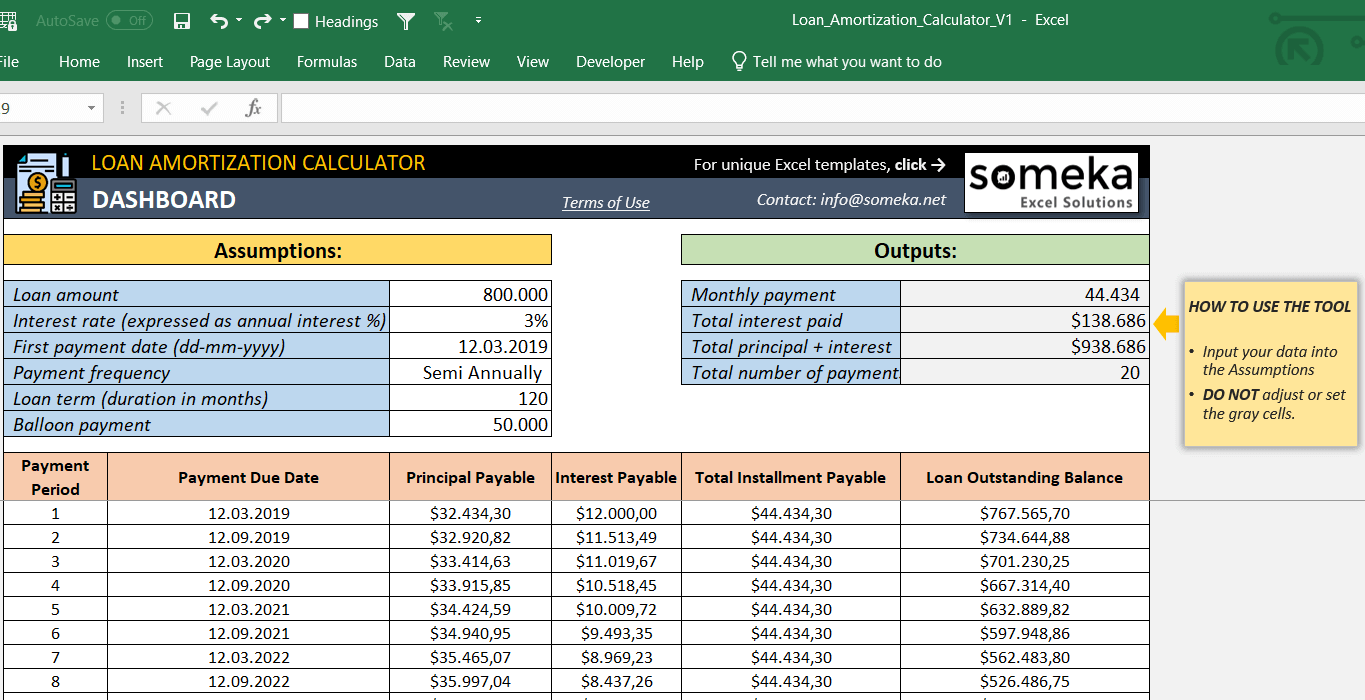

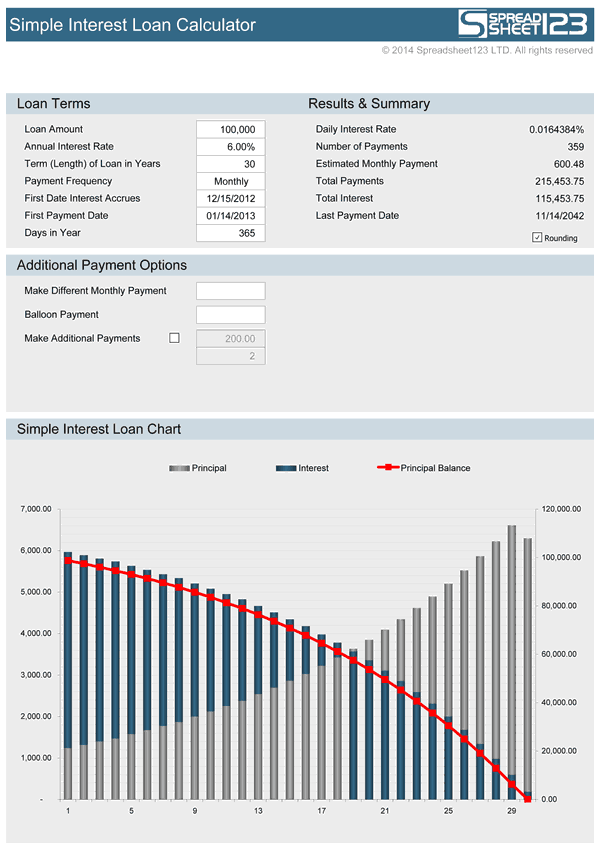

In addition to mortgages options , consider some of these program differences and mortgage terminology. Refinance calculatorInterested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you. Use our affordability calculator to estimate what you can comfortably spend on your new home.

Other tools

Even if you save $200 per month you’ll still end up with $2,400 towards your other goals at the end of the year. Set up separate accounts so you can see the sum of your savings easily. Build up a good savings history – try to develop evidence of a regular savings history before you apply for a home loan.

A 20% down payment also allows you to avoid paying private mortgage insurance on your loan. Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The "principal" is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money. It also depends on what you spend your money on day-to-day . This calculator helps you work out the most you could borrow from the bank to buy your new home. Think of it as a maximum borrowing power calculator, helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings.

TAS Stamp Duty Calculator 2022: Property Transfer Duty

The contribution you make means you own a portion of the property. The amount still owed on the loan will decrease if the borrower is able to prepay a portion of it. The bank will once more compute the EMI based on the remaining loan balance. This is the EMI that the borrower will be responsible for paying up until the interest rate is increased once more. According to the SBI website, regular home loans come with a minimum interest rate of 8.90 percent for borrowers with credit scores of 800 or above (EBR+0 % 8.90%). The risk premium is based on the CIBIL score; the lower the credit score, the greater the rate of the risk premium.

You choose the timeframe.Wholesale Term Deposit Competitive interest rates for a fixed period, that's tailored to your cash flow needs. With competitive ongoing rates, all your money goes towards your savings goals.Personal Term Deposit High interest rate guaranteed for the term. You choose the timeframe.Savings Accelerator Tiered savings account with higher variable interest rates for balances starting at $50,000. Interest rate is the base fee for borrowing money, while the annual percentage rate is the interest rate plus the lender fees.

You’ll need to know your income before tax as well as your expenses. Generally, the more you have as a home deposit, the less you’ll need to borrow and the lower your monthly repayments. ✅Spread your savings – Having a sole focus on your savings for a house is great, but you’ll also need to afford other things life brings. For example, you can save for different goals, whether it’s buying a car or planning a holiday with your family.

Your deposit amount - the smaller the deposit, the higher the cost of LMI. The size of the loan - the bigger your loan, the higher the cost of LMI. It’s also worth checking if you’re eligible for any grants or government schemes , as they can help to bolster your deposit amount. After you submit your financials, our application will come to a decision.

There are a number no deposit options on the market but they are only available through a few specialist lenders. As a personal loan is possible for high income earners with little existing debt. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans.

Subtract your expenses from your income to find out what you could repay. Your history of repayments on debts can also come into play – called your credit score . Credit reports look at how much you’ve borrowed in the past, previous applications for credit and if you’ve missed payments on things like credit cards, bills or personal loans. When taking on a mortgage in Australia, there is no simple formula that can be used to work out how much you can borrow compared to your wage. That’s because your salary is just one of many factors Australian lenders will consider when working out your borrowing power. Lenders will look at your broader financial situation, including your expenses, other debts like credit cards and how much you have saved for a deposit.

No comments:

Post a Comment